Are you a Chime bank customer who needs to access your bank statements? Knowing how to get your bank statements from Chime is essential for managing your finances effectively.

We will look at some of the reasons why you might need bank statements from Chime and explain the different ways to obtain them. Whether you need a physical copy or digital version, we’ve got you covered.

Table of Contents

Bank statements act as an essential document for financial management and record-keeping.

As a Chime bank customer, having access to your bank statements can be crucial to keeping track of your expenses, maintaining an accurate record of your finances, and timely compliance with various laws and regulations.

One of the most common reasons why you may need your Chime’s bank statements is to apply for loans or credit cards. Lenders may require several months’ worth of statements to analyze your transaction history and evaluate your creditworthiness.

Additionally, if you’re planning to buy a house or rent an apartment, landlords may also request bank statements as proof of income and financial stability. Make sure to black out personal information when sharing bank statements for apartments.

Having access to Chime’s bank statements is also important for tax purposes. The statements provide an overview of all your income sources and expenses for a specific period, which is necessary for filing your income tax returns.

Accurate and up-to-date bank statements can help ensure that your taxes are filed correctly and on time, avoiding potential penalties.

Business owners who use a Chime account can also require bank statements for various purposes. For example, when applying for business loans, investors may request bank statements to understand the financial health of the company.

Similarly, financial reports based on bank statements may be necessary for evaluating the company’s performance, analyzing trends, and identifying areas of improvement.

Access to your Chime bank statements is vital for effective financial management. Whether you’re a student, a business owner, applying for loans, or renting an apartment, having accurate and organized financial records is essential.

There are several ways to access your bank statements from Chime, depending on your preferences or requirements.

Here’s a detailed explanation of the different methods:

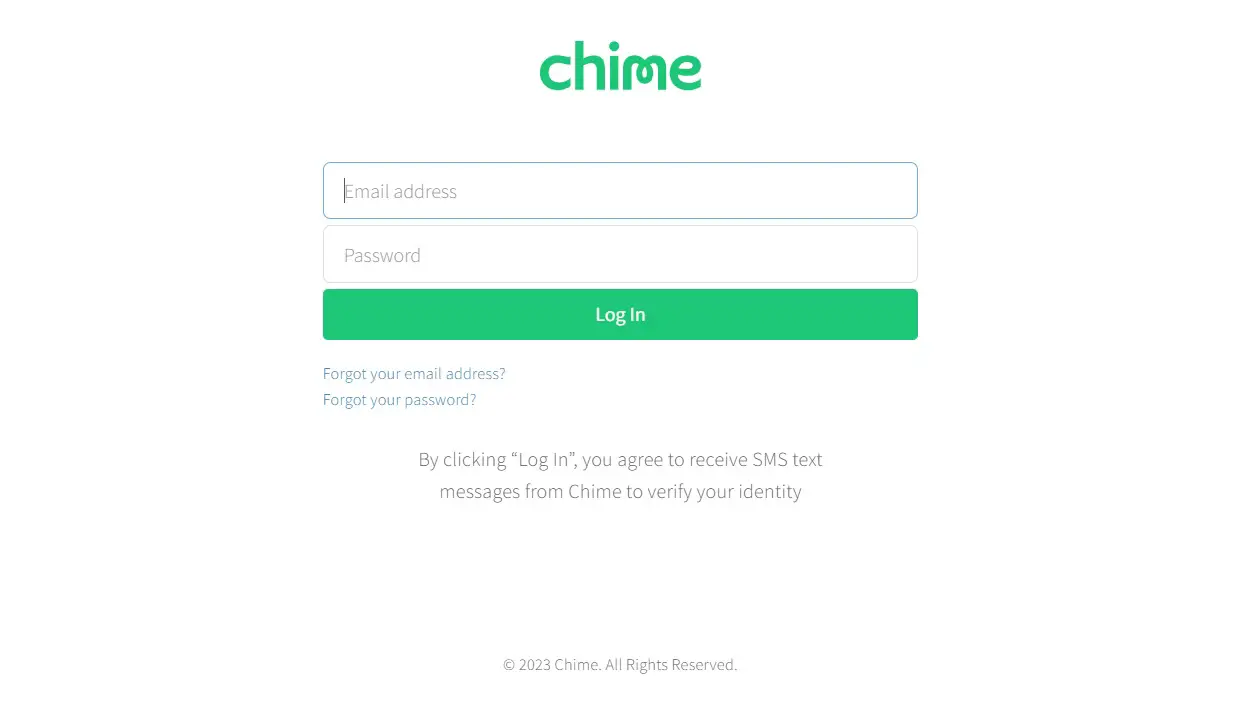

One of the easiest and quickest ways to access your bank statements from Chime is by downloading them from their website.

You can choose to save the statement as a PDF file, which you can store on your computer or mobile device for future reference.

If you need a hard copy of your Chime bank statements, you can contact Chime’s customer service team and request them to mail the statements to your registered address.

You can also call at Chime’s contact number at 1 (844) 244-6363. Chime will typically mail the statement within a few business days.

Note that there may be a fee for this service, and it may take longer to receive a copy by mail, so it’s advisable to use this option only when necessary.

Chime also offers an SMS-based banking service that allows you to access your account information, including your bank statements, by simply sending a text message.

You can text “BAL” to 43411 to receive your account balance, or “TRAN” to see your latest transactions.

However, note that this service only provides limited details, and this option is not recommended if you need detailed or comprehensive statements.

Chime also has a mobile app that you can download to your smartphone to quickly access and view your bank statements.

Start by downloading the Chime mobile application from Google Play or the App Store, depending on your device.

Download: Chime App (Android | iOS)

After installation, open the app and sign in with your Chime account login details. Click on the Settings icon on the bottom right side of the App to proceed.

In the Account Settings section, select the “Statements and Documents” option to access your Chime bank statements.

Scroll through the statements page until you find the statement period you require. You can choose from monthly or quarterly statements, depending on your preference.

Once you’ve located the desired statement, you can download it by clicking on the “Download” icon located on the right side of the screen. You can choose to save the statement as a PDF file, which you can keep for future reference.

You can then review it carefully to make sure that all the details are correct. Check the transactions, account balances, and other information to ensure that everything is accurate.

Once you’re done reviewing the statement, you can save it to your device’s internal storage or cloud storage. You can also share it via email or messaging apps with other people if necessary.

Make sure you don’t share your statements with others without knowing whether it’s safe to give others access to your bank statements.

Chime provides multiple options for getting your bank statements, from downloading them online to SMS-based services to its mobile app.

You can choose the option that works best for you, based on your preferences and requirements, and get your bank statements from Chime effortlessly.

Keeping your financial records up-to-date and accurate can help you better manage your finances, so make sure to access your Chime bank statements regularly.

ABOUT ME

With over 10 years of experience in the banking and finance industry, Thomas has a wealth of knowledge about all things related to bank transactions and personal finance.