You’re an injured spouse if your share of the refund on your joint tax return was (or is expected to be) applied against a separate past-due debt that belongs just to your spouse, with whom you filed the joint return. This can be a federal debt, state income tax debt, state unemployment compensation debt, or child or spousal support payments.

When the IRS applies your refund to one of these debts, it is known as an “offset.” If your refund has been offset, you should receive a Notice of Offset from either the IRS or the Department of Treasury’s Bureau of the Fiscal Service letting you know that the IRS used all or part of the refund to pay a past-due debt. However, if you’re not legally responsible for the past-due amount, you may still be entitled to receive your share of the refund.

![]()

If the refund amount shown on the Notice of Offset is different from the amount claimed on your joint tax return, contact the IRS to find out why. There should be a phone number on the notice. If not, call 800-829-1040.

If you lived in a community property state during the tax year, the IRS will divide the joint refund based on state law. Community property states are Arizona, California, Idaho, Louisiana, Nevada, New Mexico, Texas, Washington, and Wisconsin.

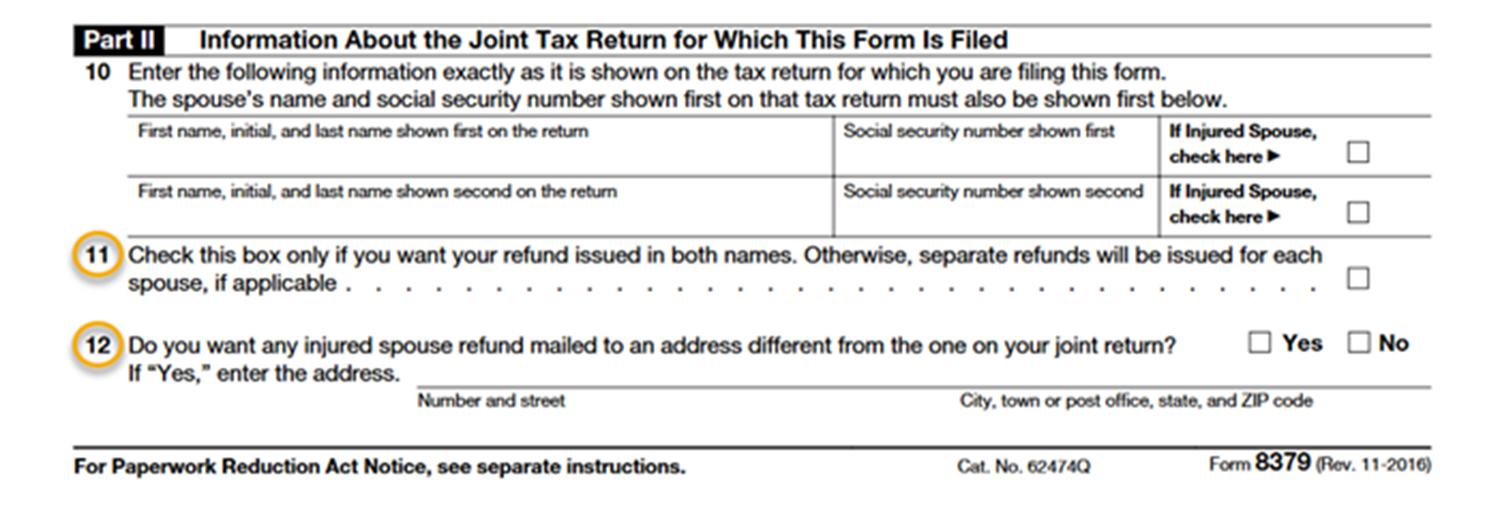

If you’re an injured spouse, you must file a Form 8379, Injured Spouse Allocation, to let the IRS know.

You need to file Form 8379 for each year you’re an injured spouse and want your portion of the refund. You can file this form before or after the offset occurs, depending on when you become aware of the separate debt, and can file it with your electronic tax return.

If you’re filing Form 8379 with your original joint return (IRS Forms 1040, 1040A, or 1040-EZ), by mail, before the IRS makes an offset:

If you’re filing Form 8379 with your amended joint return (Form 1040X), by mail, before or after the IRS makes an offset:

If you’re sending Form 8379 by itself, be sure to send it to the IRS address where you filed your original return (or the IRS address for the area where you live if you filed your original return electronically). You can find the addresses at Where to File Your Individual Return page on IRS.gov.

Important information about your refund: On Form 8379, be careful to read and answer the questions on Lines 11 and 12, if they apply to you.

If you’re responsible for the debt, you’re generally not an injured spouse. See Offsets for more information.

Generally, if you file Form 8379, Injured Spouse Allocation, with the original joint return, the IRS will process it before an offset occurs.

As you’ll see on Form 8379, items on the joint return will be allocated for each spouse. Be sure to list the correct amounts for each category.

The length of time required for the IRS to process your Form 8379 varies according to how you filed it.

If you file Form 8379 separately from your original return, there’s a chance the refund may offset before the IRS processes your claim. If this happens and you receive a Notice of Offset, contact the IRS to find out if it received your Form 8379.

To find out if you owe a debt (other than a IRS federal tax debt), and whether your refund will be offset, contact the Bureau of Fiscal Services’ Treasury Offset Program Call Center at 800-304-3107 (for TTY/TDD help, call 866-297-0517). They will tell you if you have a debt, and which agency you owe. To get more information, or to dispute the debt, you’ll need to contact the actual agency where you owe the debt.

For federal tax offsets and questions, you may contact the IRS at:

Innocent spouse relief, which has been available under IRC § 6015

The taxpayer Bill of Rights is grouped into 10 easy to understand categories outlining the taxpayer rights and protections embedded in the tax code.

It is also what guides the advocacy work we do for taxpayers.

I Can't Pay My Taxes

Refund Offsets

Did you receive a letter/notice from the IRS?

See where you are in the tax system

Visit the Taxpayer Roadmap

Understanding your notice or letter

Get Help topics

Browse common tax issues and situations at TAS Get Help

If you still need help

The Taxpayer Advocate Service is an independent organization within the IRS that helps taxpayers and protects taxpayers’ rights. We can offer you help if your tax problem is causing a financial difficulty, you’ve tried and been unable to resolve your issue with the IRS, or you believe an IRS system, process, or procedure just isn’t working as it should. If you qualify for our assistance, which is always free, we will do everything possible to help you.

![]()

Visit www.taxpayeradvocate.irs.gov or call 1-877-777-4778.

Low Income Taxpayer Clinics (LITCs) are independent from the IRS and TAS. LITCs represent individuals whose income is below a certain level and who need to resolve tax problems with the IRS. LITCs can represent taxpayers in audits, appeals, and tax collection disputes before the IRS and in court. In addition, LITCs can provide information about taxpayer rights and responsibilities in different languages for individuals who speak English as a second language. Services are offered for free or a small fee. For more information or to find an LITC near you, see the LITC page on the TAS website or Publication 4134, Low Income Taxpayer Clinic List.

View our Interactive Tax Map